For decades, Indian medical device manufacturers have capitalised on favourable tariff structures in the United States, where import duties on such products traditionally ranged from 0% to 6%. This advantageous trade environment enabled Indian exporters to position themselves as reliable and cost-effective suppliers of a wide spectrum of healthcare products including catheters, implants, diagnostic equipment, and various medical consumables within one of the world’s most demanding healthcare markets.

In an effort to reportedly strengthen its domestic manufacturing sector and safeguard employment opportunities for American workers, the United States has recently undertaken a comprehensive revision of its tariff regime, specifically targeting key imports from major trading partners. This policy shift is intended to stimulate demand for domestically produced goods, foster industrial investment, and address the structural imbalance in the nation’s trade deficit.

Among the sectors most directly affected by this revised policy of 26% tariff is the medical device industry, which holds significant importance for both the United States’ healthcare system and India’s export economy.

The United States, which reported the world’s highest per capita healthcare expenditure at $13,432 in 2023, faces mounting fiscal pressure due to an aging population and escalating healthcare costs. In this context, the imposition of higher tariffs on imported medical devices is designed not only to discourage foreign procurement by increasing the cost of such imports but also to incentivise the expansion of domestic production capacity to meet growing internal demand.

What it means for the US Healthcare providers and consumers?

The U.S. healthcare ecosystem has also been long been dependent on a robust flow of medical imports, and India plays a significant role in fulfilling that demand, especially for cost-efficient medical devices. Now, the higher import cost will place financial pressure on healthcare providers, who will face difficult decisions which is to absorb the extra cost or pass it on to patients. In either scenario, patient care may likely be compromised either through increased medical bills or delays in adopting new medical technologies. As global freight, raw material, and production costs remain elevated, the additional tariff will only deepen the gap between patient needs and provider resources.

Implications for the Indian Exporters

India has steadily established its reputation as a dependable and cost-efficient supplier of medical devices to international markets, with the United States emerging as one of its leading export destinations — recording medical device exports valued at $714.38 million in 2023.

However, the recent tariff hike significantly erodes the price competitiveness that Indian manufacturers have traditionally enjoyed, placing them at a distinct disadvantage compared to competitors from regions that remain unaffected by such elevated duties.

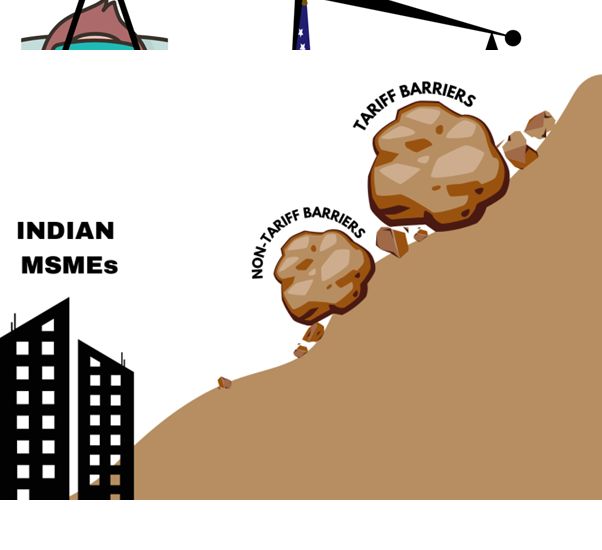

Looming challenge for the MSMEs

India’s medical device industry is primarily made up of multinational corporations as well as small and mid-sized companies, with an estimated global market share of 1.65%. The imposition of a 26% tariff significantly undermines the competitiveness of these businesses in the U.S. market, effectively rendering them uncompetitive almost immediately. For small and mid-sized companies operating on thin margins, the tariff shock could mean downsizing, layoffs, and deferred investments in research and development. This sudden shift presents a range of challenges, from unsold inventory to disruptions in cash flow, which becomes crucial for the operations of mid to small sized units.

The risk is further amplified by the possibility of trade diversion, where global competitors could reroute their products through lower-tariff countries such as the UAE, UK, or ASEAN regions, eroding India’s market share even more.

Non-tariff barriers, especially the substantial cost associated with obtaining FDA approvals for entry into the U.S. market, further complicate the landscape for Indian medical device exporters. With compliance expenses typically ranging from $9,000 to $500,000 per product, many smaller Indian firms are effectively priced out of the market even before accounting for the impact of the newly imposed tariff.

Given India’s current trade surplus with the United States, valued at $41.18 billion, these tariffs are expected to remain in place until the newly erected administration perceives a meaningful correction in the trade imbalance.

Pivot! Pivot! Pivot!

Our research indicates that while the imposition of tariffs presents significant short-term challenges, it also paves the way for a strategic realignment of export destinations over the long term. For Indian medical device manufacturers, the way forward lies in strengthening their footprint across emerging markets in Africa, Southeast Asia, and Latin America, while simultaneously moving up the value chain by developing advanced, high-tech medical devices that are less exposed to price-based competition and more in tune with evolving global healthcare needs.

Beyond strong policy frameworks such as the PLI Scheme, the Indian medtech sector must focus on tapping into markets characterised by rising healthcare demand and a growing appetite for improved medical services, products, and infrastructure. This approach will help build a more resilient and diversified demand base for Indian medical device exports, offering a buffer against the volatility of tariff-driven disruptions in the U.S. market.

For healthcare professionals, investors, and trade policymakers, this development underscores the importance of resilient sourcing strategies, diversified supplier networks, and forward-looking product development pipelines. The coming months will be a test of both adaptability and vision for India’s medical device ecosystem.

At Wellversed Media, we will continue to monitor this space closely to help businesses navigate trade complexities with research-backed insights and data-led foresight.