Introduction

India has long been recognized as a global destination for clinical research and drug development, owing to its large and diverse patient pool, cost-effective operations, and strong scientific talent. The government has recently taken a bold step to further enhance this position by introducing the New Drugs and Clinical Trials (Amendment) Rules, 2024 (“NDCT Rules, 2024”). Announced by the Ministry of Health and Family Welfare on September 19, 2024, these rules are set to come into effect on April 1, 2025.

The NDCT Rules, 2024, aim to streamline the approval process for new drugs and clinical trials, improve patient safety protocols, and ensure alignment with global standards. These reforms are expected to bolster India’s competitiveness as a preferred hub for clinical trials while enhancing transparency and safety within the clinical research process.

By opening the door to significant economic opportunities for both domestic and international stakeholders, the amendments promise to transform India’s clinical research ecosystem and strengthen its global standing in drug development and innovation.

Regulatory Reforms Fuelling FDI Growth

One of the most significant outcomes of the revised regulations is the expected increase in Foreign Direct Investment (FDI) in India’s clinical research sector. By formalizing processes and introducing stricter timelines for approvals, the government has reduced the barriers that previously deterred global pharmaceutical companies from conducting clinical trials in India. For instance, with registration approvals for Clinical Research Organisations (CROs) streamlined to a 45-day timeline, global sponsors can now anticipate faster execution of trials and quicker routes to market for their investigational drugs.

This regulatory clarity is likely to make India a key destination for global pharmaceutical giants such as Pfizer, Novartis, and Eli Lilly, which are eager to tap into India’s cost advantages and scientific resources. This shift is anticipated to accelerate the pace of drug development, foster collaborations between global and local players, and strengthen India’s position as a global hub for clinical research and innovation. These developments are expected to bring significant economic benefits and contribute to advancing cutting-edge medical technologies and treatments.

Elevating the Role of Indian CROs on the Global Stage

The formal recognition of contract research organizations (CROs) as essential stakeholders in the clinical trial ecosystem marks a critical turning point for the industry. By defining CROs as legal entities responsible for overseeing trials and ensuring scientific rigor, the amendments enhance the credibility of these organizations. This is particularly important for Indian CROs, which have long been viewed as cost-efficient but sometimes unreliable due to ambiguous regulations .

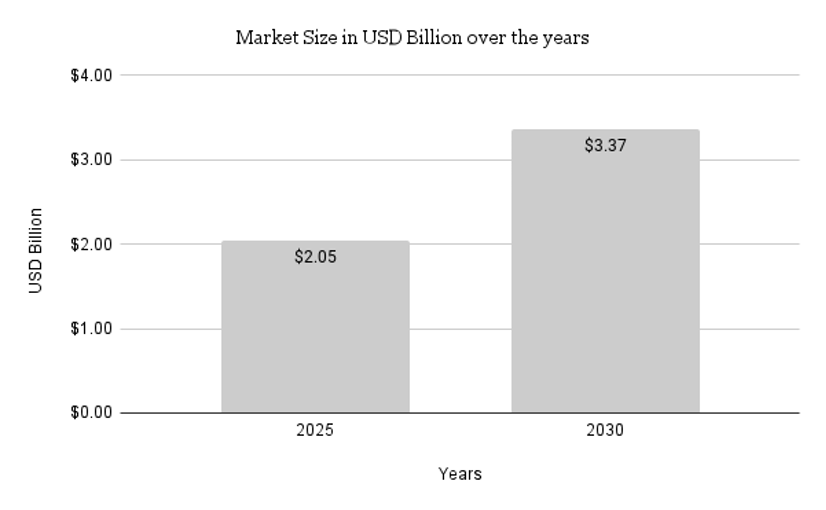

The mandatory registration of CROs with the Central Licensing Authority (CLA) ensures accountability and instils confidence among global sponsors. This move is expected to lead to a surge in international collaborations, with global pharmaceutical companies increasingly outsourcing their trials to Indian CROs. Companies like Syngene International and Veeda Clinical Research, which are already leaders in the domestic market, are well-positioned to capture a larger share of the global clinical trial market. India Clinical Trials Market was valued at USD 2.05 Billion in 2024 and is anticipated to project impressive growth in the forecast period with a CAGR of 8.64% through 2030. The CRO market industry is projected to grow from USD 0.73 Billion in 2024 to USD 1.32 Billion by 2032, exhibiting a compound annual growth rate (CAGR) of 7.23% during the forecast period (2024 – 2032).

Strengthening India’s Competitive Edge in Clinical Research

India’s regulatory reforms are bolstering its position as a preferred destination for clinical trials, alongside competitors such as China, Brazil, and the USA. Over the years, India’s contribution to global clinical trials averaged ~4% annually (2010-2022), but this improved significantly to 8.3% in 2020, driven by policy changes. Pharma-sponsored trials have grown by 10% since 2013, with industry-sponsored trials comprising 35.1% of India’s total clinical trials in 2020. Although India accounts for just 3% of global trial participants compared to the USA’s 30%, it holds immense untapped potential. These advancements are poised to attract multinational pharmaceutical companies seeking effective and scalable clinical trial solutions. (PWC), (Clinical Trials arena)

Moreover, India’s enhanced regulatory environment could encourage global sponsors to expand their Asia-Pacific operations, with India serving as the central hub. By aligning with international best practices, the amendments make India a compelling choice for trials requiring high ethical and scientific standards. Companies such as AstraZeneca, Roche, and Merck are likely to lead the way in leveraging India’s improved framework.

Boosting Domestic Economic Growth

The revised rules are poised to significantly impact India’s domestic economy. By mandating that CROs maintain advanced facilities and employ skilled professionals, the amendments are expected to stimulate job creation across various segments of the clinical research industry. This includes opportunities in areas such as clinical trial management, regulatory affairs, and data analytics. These developments are likely to enhance employment prospects, particularly in urban and semi-urban regions, as the industry expands to meet the new regulatory requirements.

Additionally, the amendments will spur investments in healthcare infrastructure and technology. CROs and sponsors will increasingly rely on advanced technologies such as AI-driven analytics, blockchain for data security, and bioinformatics platforms to meet stringent data retention and reporting requirements. This will create new opportunities for technology providers like Medidata, Veeva Systems, and Oracle Health Sciences, further stimulating the local economy.

Unlocking the Potential for Biosimilars and Generic Drug Trials

India has established itself as a global leader in the production of generics and biosimilars, and the updated regulatory framework offers an excellent opportunity to further expand clinical trials in this area. The reduced costs associated with conducting trials, coupled with operational efficiencies brought by the new amendments, position Indian pharmaceutical companies to accelerate the development of biosimilars and generics for global markets. With growing global demand for affordable healthcare solutions, companies like Sun Pharma and Dr. Reddy’s are well-placed to strengthen their market presence and enhance their reputation as key players in delivering cost-effective medical innovations.

Opportunities for Industry Consolidation and International Partnerships

The 2024 amendments are expected to drive consolidation within the CRO sector. Smaller players that are unable to meet the stricter compliance requirements may be forced to exit the market, creating opportunities for mid-sized and large players to expand through mergers and acquisitions. This consolidation will enable Indian CROs to scale operations and compete more effectively on the global stage.

At the same time, the improved regulatory environment encourages public-private partnerships (PPPs) aimed at addressing unmet medical needs. For instance, diseases with high prevalence in India, such as tuberculosis and diabetes, could become focal points for collaborative efforts between the government and private sector. Such initiatives not only address critical public health challenges but also position India as a leader in research-driven healthcare innovation.

A Catalyst for Technology and Infrastructure Investment

The new rules emphasize stringent reporting and data retention requirements, compelling CROs and sponsors to invest in robust technology solutions. From real-time trial monitoring to automated adverse event reporting, the use of advanced technologies will become indispensable. Vendors specializing in clinical trial technologies, such as Medidata and Veeva Systems, are expected to expand their footprint in India, creating new business opportunities and fostering technological advancements in the sector.

Conclusion: A Business-Driven Transformation

The New Drugs and Clinical Trials (Amendment) Rules, 2024 represents a pivotal moment in India’s journey toward becoming a global leader in clinical research. Beyond the procedural efficiencies and ethical safeguards, the amendments open the door to transformative business opportunities. By fostering transparency, accountability, and global alignment, the revised rules strengthen India’s appeal as a destination for clinical trials and drug development.

With projections of robust growth in FDI, job creation, and market share, the 2024 amendments not only promise economic prosperity but also underscore India’s commitment to advancing healthcare innovation. For domestic and international stakeholders alike, the new framework offers a unique opportunity to capitalize on India’s evolving clinical research landscape, ensuring long-term success in one of the world’s most dynamic healthcare markets.