Do small businesses have the right kind of capital to expand? Do they receive timely payment for the work they have already delivered? And does the cost of compliance encourage them to grow, or quietly push them to remain small?

By Neelambari Kakaraparthi

These questions sit at the heart of India’s MSME challenge, and for years, they were met with a familiar answer. When stress mounted, policy heads reached for bank credit. Easier loans kept enterprises afloat during difficult phases, but they rarely addressed the deeper constraint which is the ability to scale with confidence and resilience.

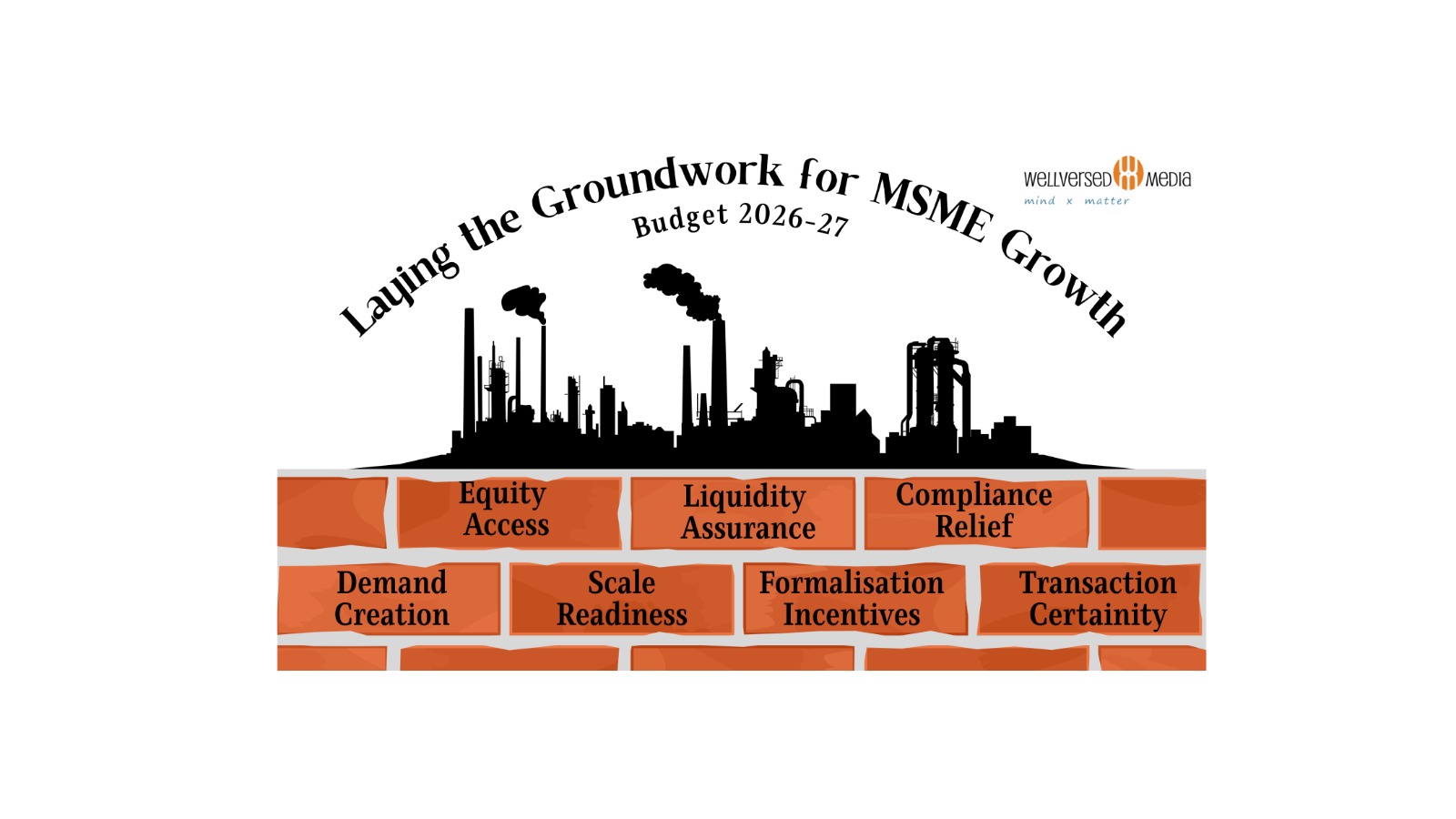

Union Budget 2026-27 marks a decisive departure from this credit-centric approach. Instead of layering fresh loans onto already stretched balance sheets, the government has turned its attention to the structural frictions that determine MSME growth. By framing its response around access to risk capital, faster and more reliable liquidity, and affordable compliance support, the Budget recasts MSMEs as engines of expansion rather than recipients of relief.

Shifting Beyond Debt

The first question the Budget confronts is whether MSMEs have the right kind of capital to grow. Debt offers stability, but it also restrains risk-taking and expansion. Recognising this, Budget 2026-27 proposes a ₹10,000 crore SME Growth Fund to create future MSME champions, alongside a ₹2,000 crore top-up to the Self-Reliant India Fund, signalling a clear shift towards equity-driven growth.

When MSMEs depend largely on loans, every step toward expansion adds balance-sheet stress and increases vulnerability during downturns. Equity, by contrast, gives firms the space to invest in technology, expand capacity, and explore new markets without immediate repayment pressure, which is an essential condition if India is to build a stronger pipeline of mid-sized enterprises.

Compared with Union Budget 2025-26, which focused on easing credit constraints by raising MSME investment, turnover thresholds and expanding credit guarantees up to ₹10 crore, Budget 2026-27 builds on the credit framework but pivots decisively towards equity-led growth. This shift also makes MSMEs more investable, opening the door to alternative investment funds, foreign capital, and even MSME IPOs over time.

Fixing Liquidity, Not Credit

The second bottleneck lies in liquidity, and it is often the most unforgiving. MSMEs rarely struggle because demand is absent; they struggle because the money they have already earned arrives late. Delayed receivables choke cash flows, push firms toward costly informal borrowing, inflate working capital needs, and ultimately force businesses to slow production, not for lack of work, but for lack of cash.

It is precisely this gap between effort and payment that the Trade Receivables Discounting System (TReDS) is designed to bridge. With over ₹7 Lakh Crore already financed through the platform, the Budget seeks to unlock its full potential through several measures such as mandating TReDS for CPSE purchases from MSMEs, extending credit guarantee support for invoice discounting, linking the Government e-Marketplace (GeM) with TReDS, and permitting securitisation of receivables to create a secondary market.

What this means for the MSMEs is shorter cash cycles and reduced dependence on fresh borrowing. Along with improving financial predictability, this creates a horizontal credit flow across value chains, ensuring liquidity reaches even the smallest suppliers rather than remaining concentrated at the top.

Lifting the Invisible Tax

The third and final question the Budget dares to confront is whether the cost of compliance enables MSMEs to grow, or quietly traps them at a small scale. Regulatory compliance functions as a fixed cost, and for smaller enterprises, that burden is often crushing, discouraging formalisation and deterring expansion. To break this constraint, the Budget introduces “Corporate Mitras.” Professional bodies such as ICAI, ICSI, and ICMAI will train accredited para-professionals in Tier-II and Tier-III towns to help MSMEs meet compliance requirements at affordable costs.

This reform matters because lower compliance costs reduce fear of formalisation. More firms entering the formal economy improves tax compliance organically, without coercion. It also allows MSMEs to scale without regulatory shock.

Demand-Side Reinforcement through Sectoral Schemes

Financial reforms alone cannot drive growth without demand. Budget 2026-27 complements its MSME framework with sector-specific manufacturing initiatives. A Focus Product Scheme for footwear and leather is expected to generate 22 lakh jobs and ₹4 lakh crore in turnover by supporting design, component manufacturing, and non-leather footwear. A new toy sector scheme aims to promote cluster development and skill-building, positioning India as a global toy manufacturing hub. The establishment of a National Institute of Food Technology, Entrepreneurship and Management in Bihar will strengthen food processing in eastern India.

In addition, a National Manufacturing Mission under Make in India will provide policy roadmaps for small, medium, and large industries, with special emphasis on clean-tech manufacturing, including solar PV cells, EV batteries, wind turbines, and high-voltage transmission equipment. These initiatives matter because credit without demand does not scale firms; but ecosystem-led demand does.

The Final Verdict

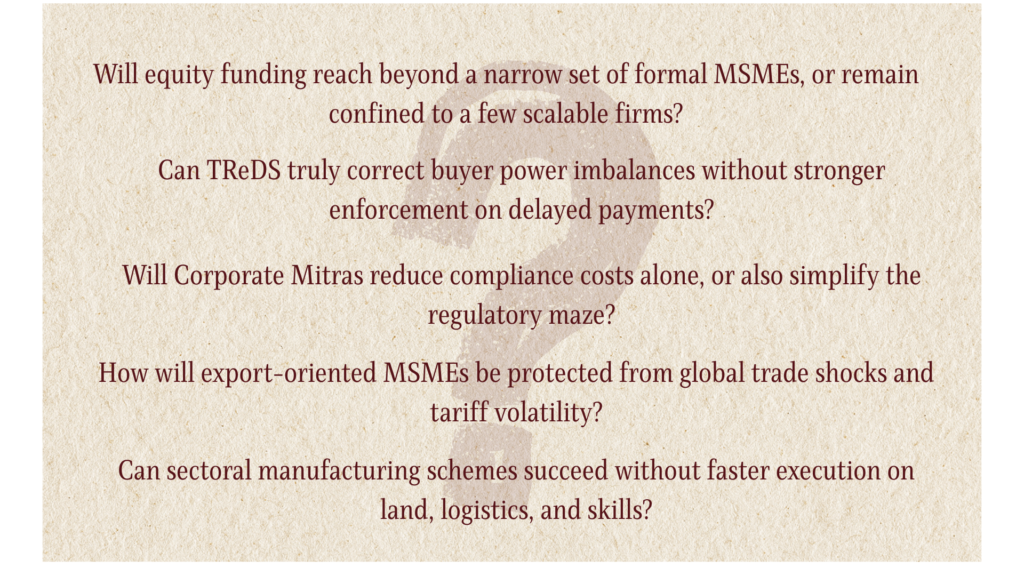

Budget 2026-27 arrives at a time when MSMEs face liquidity stress, delayed payments, and rising competitive pressures. By addressing capital structure, payment cycles, and compliance costs simultaneously, the government is strengthening the foundations of MSME growth. However, the budget’s effectiveness will be tested in implementation, particularly in addressing the following questions: